ENTREPRENEURSHIP NEWS

ENTREPRENEURSHIP NEWS

By Admin

•

06 May, 2021

The Urban League of Broward County’s Entrepreneurship Center wrapped up its very first Gov-ConTRACK training series. Eight Broward County minority businesses graduated from the 4 weeklong, 12 hour, hands on training program which taught them how to respond to a government bid. Each business successfully created a response and submitted a proposal to eight different government agencies from Broward County to Salt Lake City, Utah.

By Alica Brown

•

11 Jun, 2019

When visitors walk through the front door of A Better Foundation, they are greeted with a smiling receptionist in a room filled with bright colors used to stimulate learning. For the owner/director of the child learning center in Homestead, it’s all for good reason. “We are all about creating a positive, welcoming place,” Rocio Leiva says. For 12 years, Rocio has focused her center, just down the street from Homestead Air Reserve Base, on educating children in an environment that is physically, mentally, emotionally, and aesthetically nurturing. Rocio, age 53, knows well that the first few years of a child’s life are the most important when it comes to setting the foundations for growth, development and later life. So she and her 20-member staff put their attention on the children’s needs while building skills they will use in the years to come. It’s no longer acceptable to just teach children letters, numbers, and other basic foundations, Rocio says. Children also need to learn to be compassionate, and so the staff encourages even the youngest children to say “thank you,” “good morning,” “goodbye,” and “please” every chance they get during their time at A Better Foundation. “In today’s world, it’s so important to be respectful, kind, and loving,” Rocio says. These qualities can be missing in the home life of many of the center’s children since many of them live in a nearby homeless transition center or have parents working long shifts at the military base. Knowing the needs of the children’s families, A Better Foundation offers them donated food, clothing, diapers, toys, and many other materials. It’s all available to them when they walk into the center. Rocio’s approach to children’s learning and supporting their families is catching on across Homestead. The number of children signed up in her pre-school and after-school programs is fast growing. To keep up with the demand, the center has been expanded from 7,500-square-feet to 15,000-square-feet. The expansion includes room for a private school from kindergarten to first grade and eventually to second grade and beyond. The Capital Access Fund (CAF) from the Urban League of Broward County helped pay for the expansion, which included renovating additional bays in the shopping center where the center is based. Rocio got connected to the Urban League through a colleague at a business and leadership institute she attended in Miami. “I was trying to get financing for a long time and I exhausted all options. The Urban League opened up the door for me. I am so grateful,” she says. Running her own child learning center has been Rocio’s dream since she developed a passion for working with children at a young age. Growing up in south Miami-Dade County, she worked at a Catholic Charities child care center after finishing school. She worked her way up as an educator before realizing that there weren’t many educators running child learning centers. Many owners, she says, are business people who don’t truly understand what children need. Rocio set out to change. She took business classes and saved money until she was able to open A Better Foundation on her own. After spending much of her life preparing children for the world to come, Rocio can’t imagine doing anything else. Her payoff for all the hard work: seeing her former students get into college and aspire to do great things. “I love running the center. It feels like home to me. It’s what I’ve wanted to do my entire life and I’m doing it to the best of my ability,” she says. “It’s all about making a difference for these kids.” To learn more about A Better Foundation, call 305-257-5565.

By Alica Brown

•

10 Jun, 2019

For E. Shawn Ashley, success in business isn’t just about making money or providing for his family. It’s also about creating an opportunity for people who are often overlooked for jobs, especially those from his old neighborhood. With help from the Capital Access Fund , his Jacksonville-based company EDC3 is growing fast and will be in a position to hire more employees for its logistics, production, and supplies operations in the coming years. “We want to be the largest minority-owned business in Duval County and give many more people a shot at success that we’re blessed to have every day,” he says. His determination comes from decades of working for companies big and small and seeing first-hand the challenges facing minorities in getting access to good jobs and resources to create thriving businesses. At age 59, the easy-going father of three is quickly building a business set on social entrepreneurial values: dignity, accountability, equity, and empowerment. He wouldn’t have it any other way. Shawn grew up in Jacksonville’s northwest side, a predominately African-American part of the city where the economy wasn’t strong and many struggled to find work, much less create businesses. So, a lot of families, including Shawn’s, had their own businesses to pave their way to prosperity. His family had a small construction company and he worked there during his early years, painting, and even laying, whatever it took. As he labored in the Florida heat, with his other family members, he attended a junior college in pursuit of new skills and a career. He also worked occasional temporary jobs to make extra cash. One day, Shawn got a call to work at AT&T as a temporary stock transfer clerk answering calls from all over the country. He did good work and got invited to come back. Before long, his temporary work assignment turned into a full-time job with benefits. “We got a meal allowance and we had a cafeteria,” he recalls, laughing. “I wasn’t used to any of that level corporate professionalism and staff development.” Over time, he rose up the ranks and assumed management of the divisions in the company’s training department, call center, and eventually new business development operations. Those jobs had him supervising hundreds of employees and with a budget of tens of millions of dollars. Shawn was making good money and he enjoyed the work. But it wasn’t enough, he said. He remembered where he came from. Those memories stuck with him. He wanted to help the community. So, he turned his attention to the business of charter schools in the hope of giving students better educational options to reach their full potential. He learned real estate and the operations of the educational system. He helped open a dozen charter schools across Duval County. “We wanted our schools to be much better than the ones our students came from,” Shawn says. After years of hard work and changing lives, the economics of charter schools proved to be difficult, and Shawn decided it was time to go all in for his own business. He would build a company around his unique talents, experiences, and connections in national and international suppliers, manufacturers, and wholesalers. His company EDC3 (which stands for the first names of his family members) found a niche in providing construction building materials, appliances, furniture and fixtures, as well as offering logistics for timely delivery to meet construction, maintenance, and replacement schedules for companies of various size. Presently, his company is launching several related initiatives including private label products, in the commercial food and janitorial industries and value-added services based on customers’ requests. His clients include school districts, federal prison system, and the military. As the business took off, Shawn drilled down on his core social entrepreneurial principles. That included hiring more workers who are minorities or have special needs and joining other minority-owned businesses in the Jacksonville area in establishing a pool of financial resources to help other minority-owned businesses who are just starting out or having trouble growing. “I love creating opportunity because sharing always comes back,” he says. To him, that’s the formula for ultimate success in the business world.

By Nina McDowell

•

11 Jun, 2018

There’s a new way for minority-owned businesses in Broward County to get access to capital. The new Capital Access Fund (CAF) is a lending initiative which provides capital and business education for minority entrepreneurs. It’s available through a partnership between Morgan Stanley, National Urban League Urban Empowerment Fund, National Development Council, and the Urban League of Broward County. Message therapist Irica Dore used the fund to grow her spa business in Pembroke Pines. Here is her story: We are all looking for our Zen moment. For Irica Dore, it occurs each time she does what she truly loves: messaging her clients. With low lights and soft music playing, she stretches tired muscles and overworked joints, as her mind focuses on her mission of helping people feel better, physically and mentally. “This is my zone. I love messaging people,” she says. Irica is providing her brand of therapy from a new office in a strip mall in Pembroke Pines. She’s been a massage therapist for more than a decade, but has only recently opened her own spa, complete with therapy and skincare rooms as well as a lounge to sip tea, read, nap or contemplate. For the 36-year-old who was born in New York City and raised in South Florida, her business – Blu Bliss – is a dream come true. She knows it won’t be easy growing her clientele, paying the rent, and keeping the place beautiful so it can compete with the myriad of other spas and salons. Yet, she is optimist that her business acumen and her passion for massage therapy will bring her many successes. “Running your own business is risky. I know that. But I’m in the business of making a difference in people’s lives,” she says. “I’ve always been a people pleaser. Through massage therapy, I can help people feel better and give people a sense of wholeness and balance in their lives. If I can do that well, people will come and bring their friends. That’s how my business will grow.” And it’s grown a lot. Since going out on her own in 2010 after working at Memorial Healthcare System as a massage therapist, she built up a clientele from 20 to 100 regulars. She wants to get to 500 steady customers. Thanks to the loan from CAF, Irica is confident that she’ll reach her goal. The funding has allowed her to buy new equipment and signage, pay for building maintenance, and focus on marketing and advertising, Irica says. Over the years, she’s invested close to $35,000 of her own money into the business, mostly in renovating her current space into a multi-room spa. But the loan has given her room to concentrate on expanding her services and worrying a little less about financing. “This assistance from the Urban League has been so great,” she says. “Without it, there would be no way I could have qualified for traditional financing. I wouldn’t have met many of the qualifications.” Several other massage therapists work at Blu Bliss. But Irica’s favorite worker is her 9-year-old daughter who visits after school and enjoys helping out. “She loves answering the phones and running the front desk,” Irica says. “I love her enthusiasm. She’s seeing how I run my business and she’s picking up great values of what it’s like to work hard and be successful.” Irica spends a lot of her time planning for the future. She’s constantly looking for clients but she’s also thinking of other business ventures with her family members – perhaps buying apartments and renting them or catering special events. No matter what she does, though, massage therapy will always be a part of her life. “I love it too much,” she says. “We live in a crazy world. We all need a mental break once in a while. For me, that break comes when I do messages. I find it really soothing. It’s something I’ll always be doing.” Blu Bliss is located at 9930 NW 6th Ct in Pembroke Pines. To make an appointment, call 954-361-9015. Learn more here: www.feelblubliss.com

By Nina McDowell

•

11 Jun, 2018

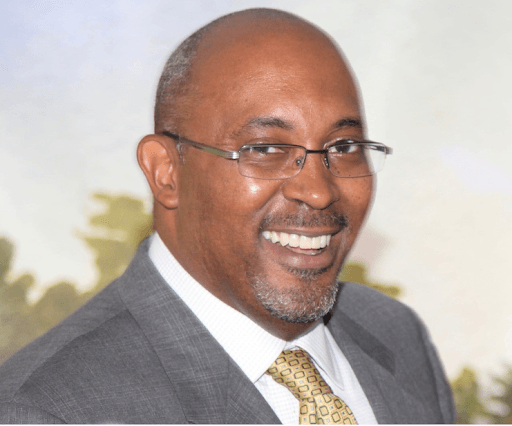

Across Broward County, Florida, minority-owned businesses are getting access to much-needed capital through the new Capital Access Fund (CAF) – a new lending initiative which provides capital and business education for minority entrepreneurs. It became available in November, 2017 through a partnership between Morgan Stanley, National Urban League Urban Empowerment Fund, National Development Council, and the Urban League of Broward County. David I. Muir, a local photographer and co-owner of a creative marketing agency, is one of the first CAF recipients. He’s relying on the fund to grow his business and seek economic empowerment. The hallway leading into David I. Muir’s apartment in an artists’ development in Fort Lauderdale is lined with stunning images of his life’s work. Radiant photos of African-American women posing naturally along city beaches, parks and streets are on one side. Striking photos of jazz musicians giving it all, their hairlines shining with beads of sweat and arms swinging to the beat, are on the other side. The photos are among the thousands he has taken over the years as he built a successful photography business, specializing in capturing the performances of entertainers, corporate events of downtown executives, and everyday lives of people from around the world. David, 49, a hardworking and gregarious father of three known to many as “Sexy Man,” has come a long way. “Taking photos is what I was destined to do,” he says. “As far back as I can remember, I wanted to be relevant and have people be interested in what I was interested in.” The nephew of an organ tuner, he grew up in Jamaica with a passion for music, art and performing. He moved to New York City, got married, and became a sought-after disc jockey with the skill to make thousands dance at festivals and other big events. He also pursued other interests, especially in education, earning degrees in philosophy and social work. After the Sept. 11th attacks, David moved to South Florida and went to work as a social worker for Family Central and then Memorial Healthcare System, focusing his time on helping troubled teens find a better path in life. Through it all, he kept taking photos of events, landscapes and people he knew. He never had any formal training but loved to chronicle images of people and things around him. While working full-time, David started taking on small photography jobs, shooting cocktail events and headshots. Soon, he realized the day-to-day work of a social worker wasn’t for him. “I liked the work but I didn’t like the notes,” he says. So he went out on his own as a full-time photographer, slowly building up his reputation by working hard at social events and corporate gatherings. His first big client: Urban League of Broward County and the annual Red Gala. “This was a huge platform and a great way to reach the community,” he says. “I was really grateful.” His business soared from there. In 2012, he published the book “Pieces of Jamaica,” a collection of snapshots of his native country. He got assignments for Jamaica’s tourism board and many other established organizations and traveled the globe taking photos of subjects at exotic and fascinating locations. As David’s reputation grew, he met Calibe Thompson, a media producer and creative consultant, and they formed a new creative agency called Island Syndicate. Their company focuses on video production, corporate branding and publishing services. They started a new Caribbean-American lifestyle quarterly magazine Island Origins, drawing attention with a rare interview with Wyclef Jean, the Haitian rapper, musician and actor. In 2017, they organized the Taste the Islands Experience food festival in Miramar and plan to do more festivals. “We work really well together,” Calibe says. “David is an ace at marketing and branding, and I’m really strong in operations.” And this is where the Capital Access Fund comes into play. Their company is relying on the loan to purchase equipment, pay for staff, and concentrate on marketing. “This money is critically important for us,” David says. “We are all about doing things at the highest level, and without a loan, there’s just so much you can’t do.” For David and Calibe, their new venture is just getting started. They plan to expand publications, video productions, and events – all of them wrapped around high-end design and, of course, eye-catching photography. “All my photos tell stories of people,” David says. “I’m really excited and blessed. I feel like everything that has happened, has happened for a purpose. I’ve already exceeded what I dreamed of and I can’t wait for what happens next.” Learn more about David’s business by visiting his website: www.davidimuir.com. To contact David, his email is: dmuir@davidiphoto.com.

By Nina McDowell

•

11 Jun, 2018

Minority-owned businesses in Broward County now have access to a new pool of capital. The Capital Access Fund (CAF) is a lending initiative which provides capital and business education for minority entrepreneurs. It’s available through a partnership between Morgan Stanley, National Urban League Urban Empowerment Fund, National Development Council, and the Urban League of Broward County. Lawanda Henderson used the funding to pursue a life-long dream of owning a child learning center. It’s helped her grow her business and plan for a new location. Here is her story. When she was a young girl, Lawanda Henderson had a favorite activity: babysitting other children. At her church, she watched children as their parents participated in the services. At her home, she played with her younger relatives on weekends while their parents ran errands and worked extra shifts at work. “If there was an opportunity to watch kids, I would do it,” she said. “I love kids. I’ve always enjoyed the role of a caregiver.” Now, at age 45, Lawanda has made caregiving for children her career – and a fast-growing business. A former school administrative assistant and track-and-field coach, she owns Taylor’s Tots Preschool, a child development center in a working-class neighborhood just outside of Fort Lauderdale. She took over the center in 2017 from a previous owner and spent thousands of her own dollars to upgrade it: refurbishing the flooring, adding cabinets, updating playground equipment, installing a security system, and beautifying the rooms with fresh paint. She made the place truly her own, adding the right touches to improve the learning experience and encourage more families to bring their children there. “Owning this center has been my life-long dream so I had to make it look just right,” she said. Lawanda had wanted to run her own child learning center since the early 1990s, but couldn’t focus on it because she started having children and needed to provide for them through a steady job as a school office manager for Broward County Public Schools. As the years passed, she built up her administrative and business skills, learning to budget, run accounting systems, dealing with staff, and taking charge of big decisions. She liked the work, but still clung to her dream of operating her own child center. Finally, last year, her opportunity arrived, when she found out the owner of Taylor’s Tots Preschool wanted to retire and sell the business. Lawanda began volunteering there and eventually, she purchased the center. Everything was set, except for the extra financing needed to run the center, which has a staff of four and two substitutes. One morning, while visiting the Urban League of Broward County to learn about the entrepreneurship center’s workshops, she ran into an employee there who was a former student from her days at the school and found out about Capital Access Fund. She had several meetings with the Urban League staff, took classes, and before long was approved for a $54,000 loan. “I was new at business and it would have been impossible to get that kind of money from a regular bank,” Lawanda said. The loan enabled her to pay down her debts, make the renovations to the center, and begin thinking about bigger plans: opening another child development center in the area. She figured, her community has many working families in need of quality child care, so why not respond to the demand? She is now looking for a location to house her new center with room for 80 children -- a place large enough to also operate a K-12 grade private school. In addition, she is determined to get a higher certification for her current center which would require raising educational standards. “I’ll get there soon,” she said, standing in a colorful room next to the kitchen where more than 20 children were quietly eating a lunch of chicken nuggets and vegetables on a recent afternoon. The children had just finished coloring booklets and reviewing other books, and Lawanda was showing a visitor how thoughtful and well-behaved the children were. “I love children and watching as they grow and develop and ask great questions,” she added. “It’s been my mission in life to give children in my community a great place to learn, be safe and get prepared for the world to come.” Her favorite part of running Taylor’s Tots Preschool is when parents tell her that their young children come home from school and proudly use new words or phrases that they learned in school. “It’s so rewarding to me when I know our work here is making a difference,” she said. To learn more about the Urban League of Broward County’s CAF and other entrepreneur programs, click here.

By Nina McDowell

•

24 Mar, 2018

Media Contact: Nina McDowell Urban League of Broward County Direct: 954.625.2545 Email: nmcdowell@ulbcfl.org For immediate release Urban League of Broward County Selected to Build Afford Housing Through New County Project FORT LAUDERDALE, FL. (March 24, 2017) – The Urban League of Broward County has been selected to build affordable single-family homes as part of a new Board of County Commissioners project to construct more homes for qualifying very-low to moderate-income households across Broward County. The county’s Housing Finance and Community Redevelopment Division of Broward County has entered into an agreement with the Urban League and nine other Broward County nonprofit housing agencies to construct forty new affordable single-family homes. Each nonprofit agency, including the Urban League, is being awarded four lots to build homes with a minimum of 1,500-square-feet, three bedrooms, two-baths and a two-car garage. The agencies will need to get permits within six months and complete construction 12 months after permitting. The homes will be available for purchase through a lottery system to very-low to moderate-income households who qualify for first mortgage financing with an approved lender and who will use the homes as their primary residence. The County may also provide purchase assistance for qualified buyers. All new buyers are required to attend homeowner education class and meet current Housing Finance and Community Redevelopment Division underwriting criteria for the home purchase and loans. “This is a wonderful opportunity to provide homeownership opportunities for families wanting a place of their own,” said Germaine Smith-Baugh, Ed.D., president and CEO of Urban League of Broward County. “We are excited to have been selected for this much-needed project to provide homeownership for families who too often have a difficult time finding decent and safe places to live.” Applications will be available starting April 3 at Housing Finance and Community Redevelopment Division or online at Broward.org/Housing/Pages/Default.aspx . The application period will be open until 12 PM, May 26 and completed applications need to be delivered in person to the following address: Housing Finance and Community Redevelopment Division 110 NE Third Street, Suite 300 Fort Lauderdale, FL 33301 Office Hours: Monday - Friday, 8:30 AM to 5 PM, excluding holidays For further information call: 954-357-4900. The other participating nonprofit agencies are: 1. Broward Alliance for Neighborhood Development (BAND) 2. Dania Economic Development Corporation 3. Habitat for Humanity of Broward 4. Housing, Opportunities, Mortgage Assistance and Effective Neighborhood Solutions, Inc. (HOMES) 5. Housing Foundation of America 6. Liberia Economic and Social Development 7. Minority Builders Coalition, Inc. 8. Neighborhood Housing Services of South Florida, Inc. 9. Sunrise City Community Housing Development Organization, Inc. About Urban League of Broward County The Urban League of Broward County is a not for profit organization founded to empower communities and change lives. Our mission is to assist African Americans and other disenfranchised groups in the achievement of social and economic equality. Our “Breaking the Cycle” programs uplift more than 11,000 people every year through affordable housing initiatives, youth development and diversion, employment and training, community empowerment, and civic engagement. Learn more about the Urban League of Broward County by visiting: www.ulbroward.org .

Sponsored by the Urban League of Broward County and the State of Florida, Department of Economic Opportunity

© 2024

All Rights Reserved | Urban League of Broward County. All Rights Reserved.

Urban League of Broward County is a 501(c)(3) nonprofit organization in the State of Florida | Privacy Policy